Element #5: Asset Allocation

Element #5: Asset Allocation: This continues our discussion of the eight customizable Elements of a personal retirement withdrawal plan.

Of the Eight Elements, this one is the most complex, with the widest range of choices. The first choice is between Fixed and Variable allocation: in other words, do you plan to maintain a fixed allocation of assets during retirement (restored periodically by rebalancing), or will you permit the allocation to vary according to some set of rules?

Considering a fixed allocation first, my research with seven asset classes (US Large Company stocks, US Mid-Cap stocks, US Small-Cap stocks, US Micro-cap stocks, International stocks, 5-year US Govt bonds, US Treasury Bills) suggests that an allocation of 60% stocks/35% fixed income is optimum (for a 30-year planning horizon and tax-advantaged account). This presumes an allocation of 5% to Treasury Bills (Cash proxy). However, varying stocks between about a fixed 46% to 75% of the portfolio produces little significant change to withdrawal rates. Stock allocations outside that range can cause the withdrawal rate to dip considerably.

My research suggests that worthwhile gains in withdrawal rates can be achieved by slightly overweighing the highest-returning stock classes (such as small cap stocks).

Note that for some historical retirees, higher or lower stock allocations worked better, depending on circumstances at the time of retirement. Retiring at the start of a secular bull market, for example, tended to favor a higher initial stock allocation.

Variable stock allocations during retirement can take many forms. For example, the "rising glidepath" approach (first proposed by Kitces and Pfau), begins retirement with a low stock allocation, and increases it annually by some fixed percentage. My research suggests this has been a very successful strategy.

One may also employ risk management methods, which adjust stock allocation periodically and incrementally in response to changing perceptions of stock market risk. I believe that, to protect their nest egg, retirees should seriously consider using the advice of a third-party risk manager.

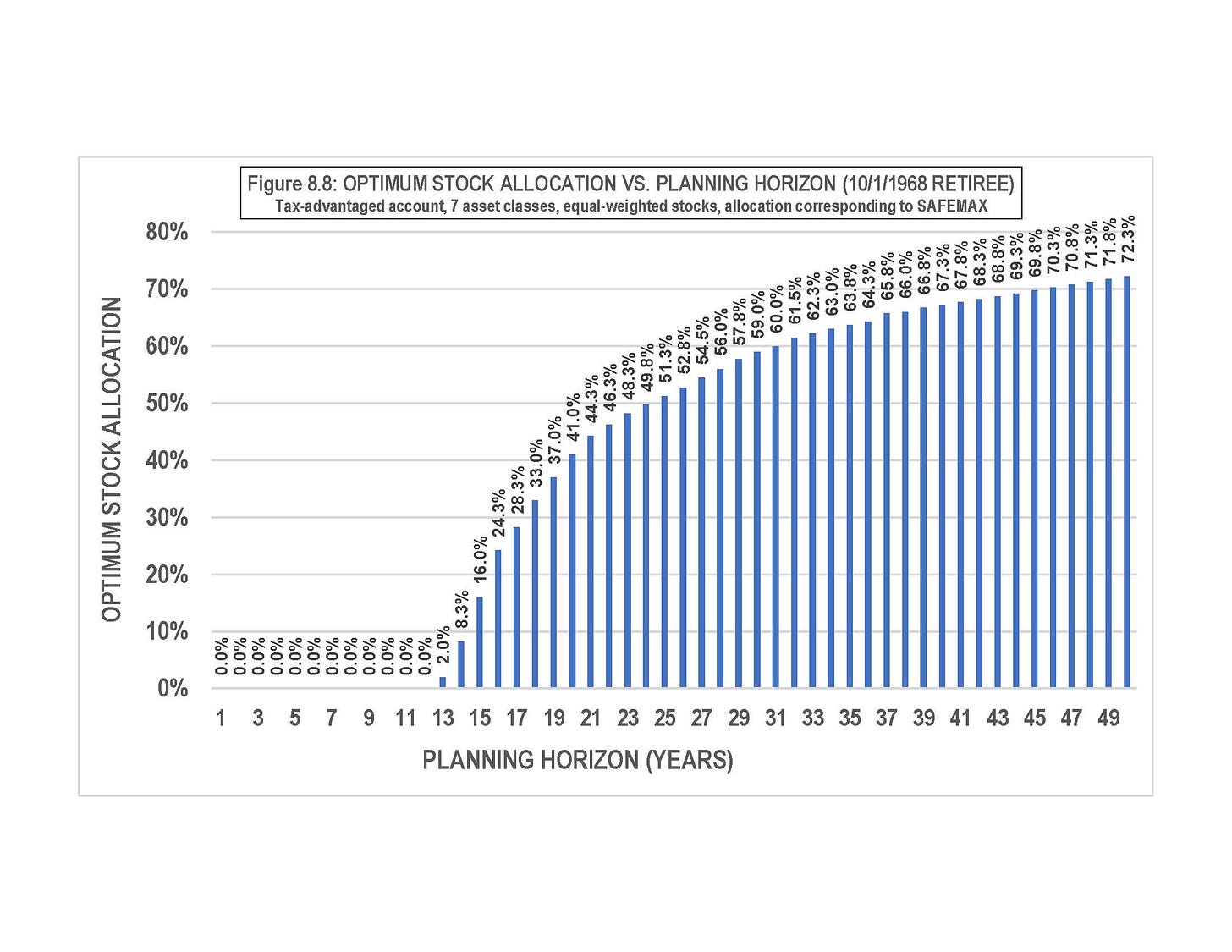

In closing, note that optimum allocation can be significantly impacted by the length of the planning horizon, as shown in the accompanying chart.

Next time: Element #6, Portfolio rebalancing.

#4percentrule

#fourpercentrule

#retirementincome

#RetirementSpending

#bengenrule

#billbengen

#williambengen

#RetirementPlannin

g